How to freelance or run a business

The essentials to run a business, consultancy or freelance in Germany: register, get a tax number, healthcare, invoicing.

A honest review of Fyrst, Holvi, Kontist, Finom and Wise.

This article is for everybody who is operating a business based in Germany and needs a business bank account.

Small businesses and freelancers in Germany can use their private German bank accounts for invoicing clients but it is not guaranteed that the bank will not shut the account down and force you to use their business account (Geschäftskundenkonto). Some banks like Berliner Sparkasse and N26 tolerate income from freelancer activities on private accounts. Please note that any business registered as a GmbH, GmbH & Co. KG or AG is required by law to open a dedicated business account source.

Business accounts with traditional German banks are usually more expensive than private accounts. Some German NEO banks step up with more attractive offers for small businesses. The following list only includes business accounts that have a free plan with a fully functional IBAN acount and English language support. Many of the featured business accounts offer some sort of accounting and tax services in their paid plans.

Some banks have reports of frozen funds source. The reasons are sometimes unclear and can be anything from customers paying with stolen credit cards to payments in other currencies. I recommend to always keep your money spread across several bank accounts with different banks.

Wise has a *Wise business account with no monthly subscription fees.

Some features of the free Wise business account:

Optional features:

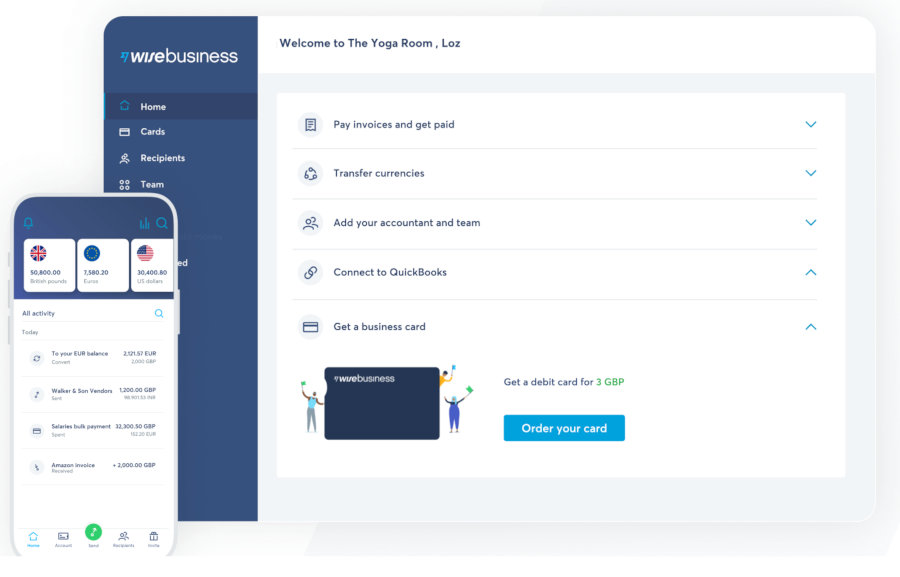

A screenshot of the Wise Business app. Wise offers interesting multicurrency features for international businesses.

A screenshot of the Wise Business app. Wise offers interesting multicurrency features for international businesses.*Sign up with the Wise Business account here.

I heard many good things about the *Kontist bank account for self-employed. They offer an app for managing business finances which comes with a business bank account in the English language and accounting features. The self-employed checking account is free as long as you have a minimum of 300.- Euro worth of transactions per month. The first 10 transactions are free, subsequent transactions cost 0,15 Euro each.

Features of the free Kontist self-employed account:

Features in the paid plans:

The free Kontist plan can be upgraded to paid accounting features.

The free Kontist plan can be upgraded to paid accounting features.*Sign up with the Kontist self-employed account here.

The *Finom business account integrates a free checking account with invoicing features.

Notable Finom free business account features are:

Features available in the paid plans:

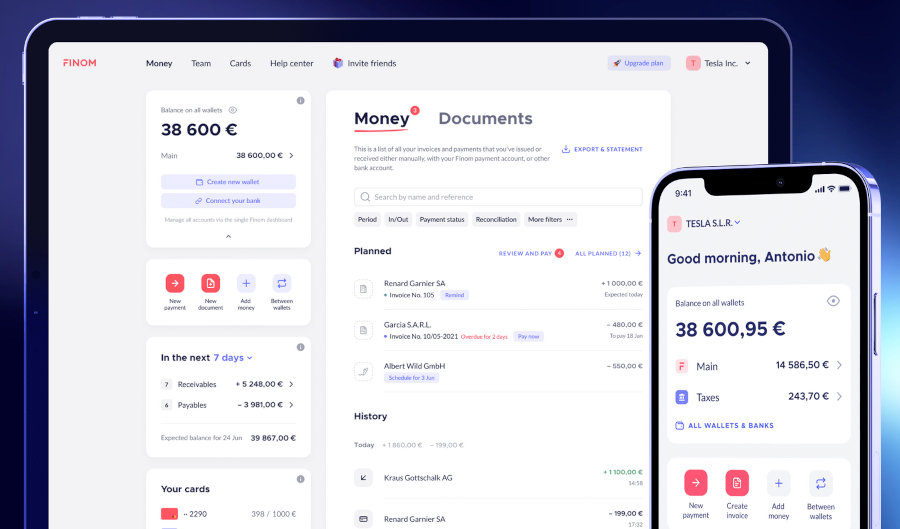

Finom can be used to aggregate data from other bank accounts.

Finom can be used to aggregate data from other bank accounts.*Sign up with the Finom business account here.

I use Finom as a business account. The Finom app user interface is very easy to use although there are some bugs. The customer support is very responsive and usually replied within minutes.

*Fyrst offers a great business account. Note that the starter package is free only up to 50 booking entries. Fyrst is the only app in this list that is German language only.

Fyrst free business account features:

Fyrst does not have an English version.

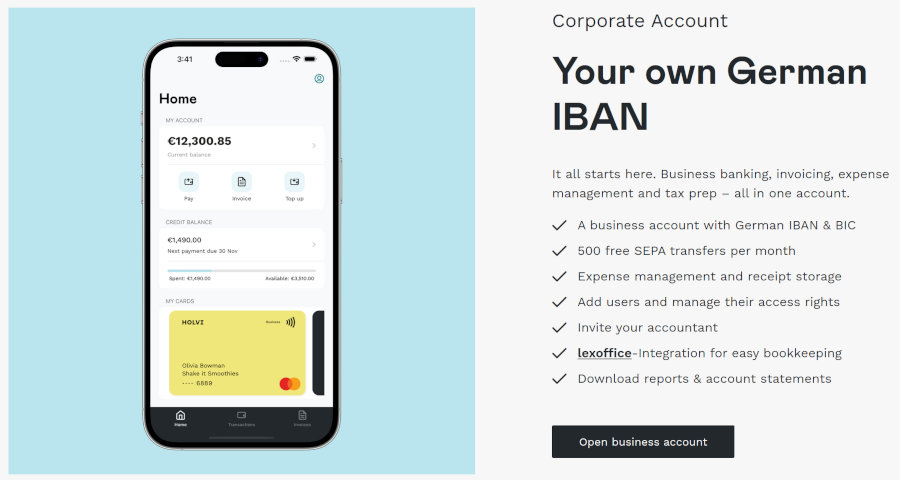

Fyrst does not have an English version.*Holvi is another business account for freelancers with full English support. *Click this link, then select En in the navigation.

Holvi does not have a free plan but the Holvi Lite account offers many features for only 9.- Euro / month which is cheaper than the paid plans of most other business accounts.

The Holvi app features.

The Holvi app features.Holvi Lite features:

The essentials to run a business, consultancy or freelance in Germany: register, get a tax number, healthcare, invoicing.

Find an English speaking tax consultant close to your address.

The fastest way to do your taxes in Germany without speaking German. A review of Wiso, Smartsteuer, Wundertax, Sorted.

Introduction into taxes in Germany for consultants, freelancers and other self-employed. This article gives you an overview of the most important types of taxes.

An overview of the different types of work visas in Germany. A starter guide for everybody who wants to work in Germany.

What is the procedure when visiting a doctor or a hospital in Germany? How long do I have to wait for appointments? What is the quality of the treatment? What are the cos...

The best German bank accounts in 2024 for expats. A honest review of N26, DKB, 1822direkt, bunq, ING-DiBa and many more.

The German Blue Card visa is an option for a permanent residence permit if you are looking to work in mathematics, IT, natural sciences, engineering or human medicine or ...

An independent 2024 review of the best German public and private health insurance plans for singles, couples and families including expat health insurance for visa applic...

How to dial a phone number in Germany.

The best German mobile phone and prepaid plans for expats. A review of Smartmobil, Telekom, Vodafone, Lebara, fraenk.

Public vs private health insurance in Germany for foreigners. Your options and why cheap plans might turn out to be more expensive in the end.

What to pay attention for when applying for private health insurance in Germany.

A guide to getting a German work visa for employees. This visa allows you to work and live in Germany.

Get your money back if you have to cancel your trip because of Corona.

This guide walks you through the all the necessary steps to remotely find a job in Germany, including an overview of the most important job search engines and common appl...

Freelance artists or publishers in Germany are entitled to cheaper healthcare plans via the Künstlersozialkasse (KSK). A step by step guide.

A review of the most useful health apps in Germany.

A step by step guide to get a visa to freelance in Germany.

You can't do all the work at home anymore and need help? Follow this step by step guide to get help covered by your German health insurance.

A step by step guide to find a doctor which speaks your language in Germany based on your ZIP code.

A step by step guide to get your money back if an airline cancelled a flight but does not refund the money.

A honest review of German internet providers and how the pick the best one for your location (and save money).

A step by step guide to register an address in Germany. This is called Anmeldung an necessary to get a tax id, open a bank account or to sign up for health insurance.

All about the German student visa, the application process and required documents.

A guide to find the best electricity company in Germany, including comparison websites, and companies with English support.

Our guide shows you the necessary steps to open a bank account as a foreigner in Germany.

An introduction into the German tax system for employees.

83% of German households have a private liability insurance. Get protection for as little as 43.- Euro per year. A review for expats including dog liability.

A bureaucratic nightmare with a happy end.

A checklist of steps to do after you found a flat: registration, electricity and internet providers, moving services, useful insurances and warnings of possible scams.